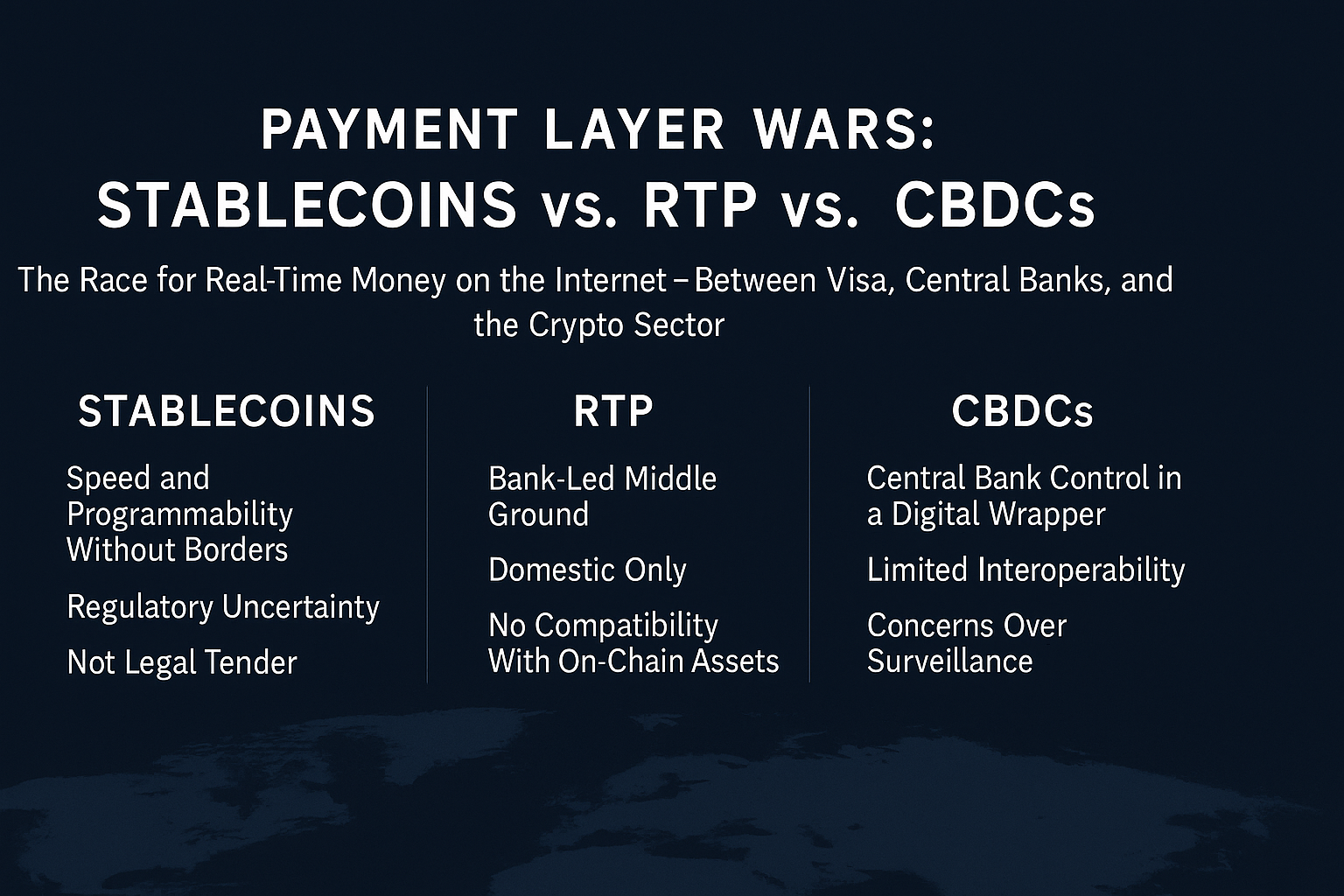

The Race for Real-Time Money on the Internet — Between Visa, Central Banks, and the Crypto Sector

In a world that operates around the clock, money remains stubbornly offline. That’s changing—fast. Three fundamentally different approaches are now competing to define the future of programmable, instant digital money:

- Stablecoins – Tokenized fiat issued by private entities

- CBDCs (Central Bank Digital Currencies) – Sovereign digital currencies

- RTP Systems (Real-Time Payments) – Centralized bank-led systems like FedNow, TIPS, PIX, and Visa Direct

Each promises speed, scale, and security. But behind the scenes, the battle is one of ideology, control, and infrastructure ownership.

1 | Stablecoins: Speed and Programmability Without Borders

Advantages:

- Instant, global settlement

- Interoperable with Web3 and programmable systems

- Highly liquid across exchanges and DeFi

Challenges:

- Regulatory uncertainty, especially in the United States

- Counterparty and reserve transparency risk

- Not legal tender

Stablecoins like USDT and USDC already settle billions in daily volume. Increasingly, they underpin cross-border remittances, on-chain FX, and even tokenized Treasuries. They are becoming the default payment rail for open financial networks.

2 | CBDCs: Central Bank Control in a Digital Wrapper

Advantages:

- Backed by sovereign authority

- Can embed monetary policy logic (e.g. expiration, negative rates)

- Could reduce settlement risk in wholesale markets

Challenges:

- Limited interoperability with open blockchain infrastructure

- Concerns over surveillance and privacy

- Often slow to launch and iterate

Examples include China’s e-CNY and the upcoming digital euro. These systems aim to retain monetary sovereignty in a digitized world. But the adoption case remains unclear outside of state-mandated pilots.

3 | RTP Systems: The Bank-Led Middle Ground

Advantages:

- Already operational and connected to existing financial institutions

- Compliant by design

- Familiar to regulators and commercial banks

Challenges:

- Domestic only; cross-border integration is weak

- No programmability or smart contract support

- No compatibility with on-chain assets

Systems like FedNow in the U.S., TIPS in Europe, and PIX in Brazil are improving access to faster fiat transfers. But they are not designed to function in decentralized, tokenized ecosystems.

4 | Comparative Assessment

| Criteria | Stablecoins | CBDCs | RTP Systems |

|---|---|---|---|

| Programmability | Strong | Medium | Weak |

| Legal Backing | Medium | Strong | Strong |

| Global Reach | Strong | Weak | Weak |

| Regulatory Maturity | Low | Medium | High |

| Developer Ecosystem | Strong | Weak | Weak |

| Privacy & Autonomy | Medium | Low | Low |

| Settlement Finality | High | High | High |

5 | Geopolitical Dimensions

This is more than a technical race. The outcome shapes who controls digital liquidity, how programmable money behaves, and which jurisdictions define the monetary norms of the internet.

- The U.S. leads in stablecoin issuance, but lacks a CBDC

- China leads in CBDC deployment, but restricts usage

- The EU is betting on MiCAR to regulate both sides of the market

- Emerging markets like Brazil and Nigeria are moving fast on RTP and CBDC adoption

The battlefield is not just financial—it’s political and infrastructural.

6 | Conclusion

The global payment layer of the future will not be won through technology alone. It will be determined by the model that combines speed, compliance, interoperability, and user control.

- Stablecoins are currently ahead in usability and global reach

- CBDCs have the clearest institutional backing

- RTP networks are adapting, but remain limited by design

The convergence point—if it emerges—will likely come from hybrid models: regulated, tokenized money that is programmable, compliant, and natively internet-based.

Until then, the competition is wide open.