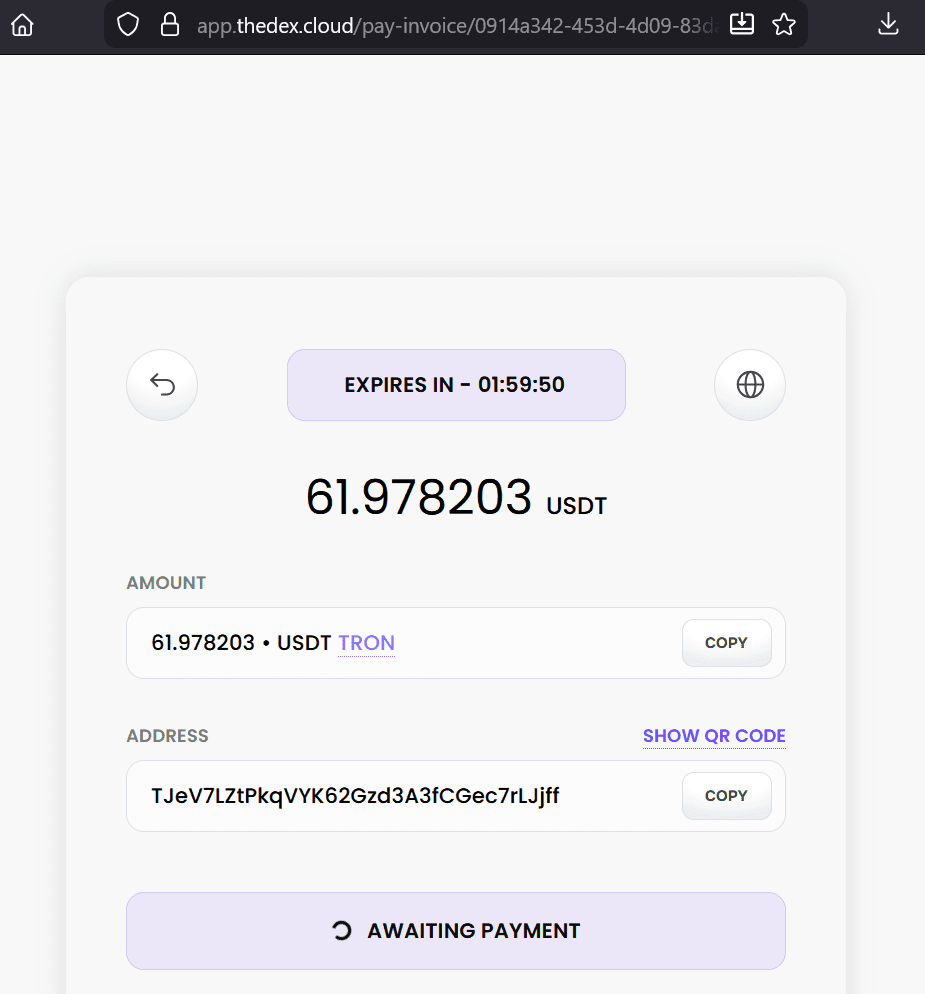

RatEx42, the leading compliance intelligence platform, today announced the formal listing and immediate Black (Critical Risk) rating for TheDex, a crypto payment gateway operating via thedex.cloud. This unprecedented designation stems from a comprehensive investigation revealing TheDex’s complete corporate opacity, active solicitation of the high-risk iGaming sector, and total absence of regulatory licensing, positioning it as a primary facilitator of financial obfuscation for entities like Verde Casino.

TheDex: The Ghost in the Machine of Offshore Gambling

“TheDex represents the pinnacle of ‘ghost branding’ in the high-risk payment processing industry,” states a Senior Compliance Analyst at FinTelegram, RatEx42’s intelligence partner. “This provider offers a full suite of crypto payment and mass payout solutions, explicitly targeting the ‘Entertainment & Media’ sector—a clear euphemism for unlicensed iGaming. Yet, it operates without any discernible legal entity, registered address, or regulatory oversight. It’s an anonymous on-ramp for anonymous money.“

The investigation confirms that TheDex functions as a critical component in the “shadow rail” infrastructure, enabling platforms like Verde Casino to accept and disburse funds globally, bypassing traditional banking controls and regulatory scrutiny. Verde Casino is operated by Briantie Limited in Cyprus and Wiraon B.V. in Curacao. The casino and its operators do not have a license to operate the casino in the EU, UK, or other jurisdictions. It is an illegal casino.

Read the report on Verde Casino here.

By specializing in rapid, high-volume crypto conversions and mass payouts, TheDex provides the liquidity necessary for these offshore operations to thrive, often at the expense of player protections and financial integrity.

Why the “Black” Rating?

The Black (Critical Risk) rating by RatEx42 is reserved for entities that pose an extreme and immediate threat, exhibiting systemic characteristics of severe non-compliance, active obfuscation, and a total lack of accountability.

“The complete absence of a legal identity for TheDex is not an oversight; it’s a deliberate strategy,” the analyst emphasizes. “This anonymity shields the beneficial owners from legal repercussions, complicates any attempts at regulatory enforcement, and makes it impossible for financial institutions to conduct meaningful due diligence. Engaging with TheDex means engaging with a financial phantom—a risk no regulated entity should ever take.”

A New Frontier of Regulatory Avoidance

The rise of operators like TheDex highlights a growing challenge for global financial regulators. As jurisdictions like Lithuania implement stringent frameworks like MiCA, illicit operators are adapting by moving towards more decentralized and opaque infrastructure providers. TheDex’s business model epitomizes this trend, offering “whitelabel” solutions that allow other entities to create their own anonymous payment gateways, further proliferating the shadow banking ecosystem.

Financial institutions, payment service providers, and even technology vendors involved in the iGaming or crypto sectors are put on high alert. Any connection to TheDex represents a critical AML/CFT vulnerability and a significant reputational hazard.

Call to Action for Financial Institutions & Operators

RatEx42 urges all financial institutions and payment service providers to immediately cease any direct or indirect engagement with TheDex (thedex.cloud). Due diligence on existing crypto-related counterparties should include an assessment of their upstream and downstream connections to “ghost-branded” processors.

For iGaming operators, choosing anonymous payment rails like TheDex not only exposes players to significant risks but also places the operators themselves in a precarious position, vulnerable to sudden service disruptions and potential regulatory blacklisting.

View the full Compliance Profile for TheDex on RatEx42.com.

About RatEx42: RatEx42 is a cutting-edge compliance intelligence platform that provides real-time, in-depth risk assessments and investigative reports on high-risk payment processors, VASPs, and financial entities. Powered by FinTelegram’s extensive network, RatEx42 helps financial institutions, regulators, and businesses navigate the complex landscape of financial crime and regulatory compliance.