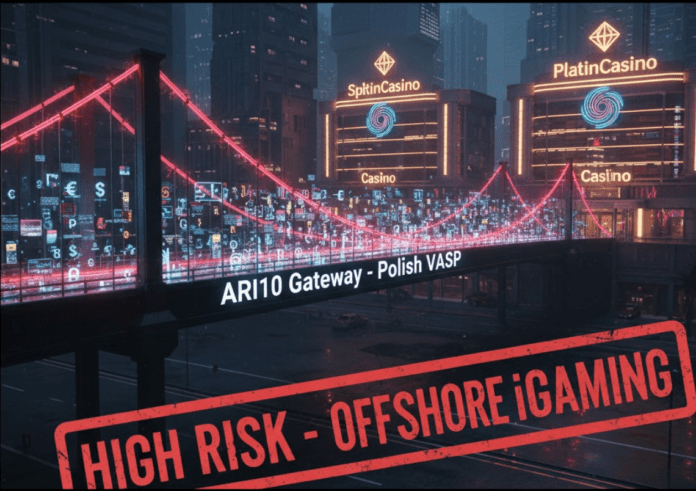

RatEx42, the leading compliance intelligence platform, today announced the formal listing and immediate Red (High Risk) rating for the ARI10 Group, including its primary operating entity Bitcan sp. z o.o. This critical designation follows a comprehensive investigation revealing ARI10/Bitcan’s central role as a crypto-fiat on-ramp for illegal offshore casinos, specifically identifying its deep integration with platforms such as PlatinCasino and SpinFin Casino.

ARI10/Bitcan: The Polish Bridge to Unlicensed Gambling

“The ARI10 Group, operating through Bitcan, exemplifies the ‘Polish Shelter’ strategy we’ve identified in the wake of Lithuania’s strict MiCA enforcement,” states a Senior Compliance Analyst at FinTelegram, RatEx42’s intelligence partner. “While Bitcan holds a valid VASP registration in Poland, our investigation reveals its pervasive use as a conduit for ‘transaction laundering’—allowing players to fund offshore gambling accounts under the guise of legitimate crypto purchases.”

The investigation confirms that ARI10/Bitcan’s B2B crypto payment gateway is a preferred rail for unlicensed iGaming operators targeting the EU market. By providing a technical bridge that converts fiat currency (like Euros) into crypto assets, Bitcan effectively masks the true nature of these transactions from traditional banking systems. This circumvents gambling blocks and, crucially, strips players of their consumer protections, including chargeback rights, for losses incurred on illegal platforms.

Why the “Red” Rating?

The Red (High Risk) rating by RatEx42 is reserved for entities that pose a significant and imminent threat of financial crime, severe regulatory non-compliance, and substantial reputational risk to any financial institution interacting with them.

“ARI10/Bitcan’s systematic facilitation of payments for entities like PlatinCasino and SpinFin Casino, which operate without local licenses, is a clear and present danger to the integrity of the European financial system,” the analyst explains. “Their active participation in the ‘Polish Shelter’ strategy demonstrates a deliberate intent to capitalize on regulatory arbitrage during the MiCA transition, making them a high-risk counterparty for any regulated entity.”

The MiCA Transition and the Polish Shelter

As Lithuania’s tough MiCA deadline led to the suspension of numerous high-risk VASPs, Poland’s slightly longer transition period (ending July 2026) has made it an attractive relocation point. ARI10/Bitcan, already a significant player in the Polish crypto landscape, appears to be absorbing this displaced volume, acting as a crucial link for operators seeking to extend their access to EU markets before full MiCA compliance becomes mandatory across the bloc.

Financial institutions, especially those processing payments from or to Polish VASPs, are urged to intensify their due diligence. The presence of entities like ARI10/Bitcan in a payment chain should trigger immediate red flags for transaction masking and illicit gambling facilitation.

Call to Action for Financial Institutions & Operators

RatEx42 urges all financial institutions and payment service providers to exercise extreme caution when dealing with the ARI10 Group and Bitcan sp. z o.o. Merchants, particularly those in the iGaming sector, should be aware of the inherent risks of partnering with processors that facilitate unlicensed operations, as this could lead to regulatory action and severe reputational damage.

View the full Compliance Profile for ARI10/Bitcan

About RatEx42: RatEx42 is a cutting-edge compliance intelligence platform that provides real-time, in-depth risk assessments and investigative reports on high-risk payment processors, VASPs, and financial entities. Powered by FinTelegram’s extensive network, RatEx42 helps financial institutions, regulators, and businesses navigate the complex landscape of financial crime and regulatory compliance.