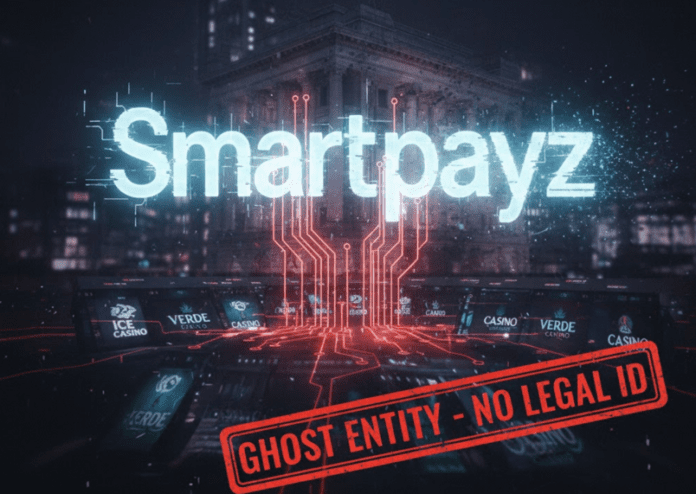

RatEx42, in partnership with FinTelegram, today officially issues a Black (Critical Risk) rating for the payment gateway Smartpayz (smartpayz.com). This designation follows a forensic audit that confirmed a “Ghost Entity” status: the provider claims a professional UK corporate presence but has no verifiable legal existence in the UK Companies House or any other major financial registry.

The “Ghost” in the Cashier: How Smartpayz Deceives the System

Our investigation has uncovered a systematic pattern of corporate mimicry. While Smartpayz markets itself to high-risk merchants as a stable, “Western” payment orchestrator, it operates behind a veil of anonymity. The previously suspected legal wrapper, Smart Payz Limited, does not exist in the UK corporate register.

“Smartpayz is the definition of a financial phantom,” says a Lead Investigator at FinTelegram. “By operating without a legal entity, they ensure there is no door to knock on when funds go missing, no director to hold accountable for AML failures, and no regulatory body that can issue a cease-and-desist. They are a purely offshore ghost operation using a ‘.com’ domain to buy legitimacy.“

Fueling the Underground iGaming Economy

Smartpayz is not merely a technical failure; it is a specialized tool for the illegal iGaming market. The platform is deeply integrated into the payment stacks of major offshore groups, including the Galaktika N.V. network (operators of Sol Casino, Jet Casino, and Fresh Casino) and the Brivio Limited umbrella (operators of Verde Casino and Ice Casino).

The gateway excels at “Cascading Obfuscation.” When a player’s credit card is declined for gambling, Smartpayz instantly triggers a secondary “Ghost Rail.” This rail redirects the transaction through a series of P2P (Peer-to-Peer) bank transfers or unregulated crypto-on-ramps. The player’s bank statement eventually shows a benign purchase—such as “Software Services” or “Consulting”—while the funds are actually fueling unlicensed gambling sites.

Why “Black” is the Only Appropriate Rating

A Black (Critical Risk) rating is reserved for entities that have crossed the line from “high risk” to “systemically fraudulent.” Smartpayz earns this rating for:

- Identity Fraud: Deceiving merchants and banks regarding its UK corporate status.

- Lack of Accountability: Operating without a legal personhood, making lawsuits or fund recovery impossible.

- Money Laundering Risk: Providing a permissionless conduit for unlicensed casinos to move millions of Euros out of the EU banking system into offshore crypto-wallets.

Urgent Warning to Compliance Officers

Financial institutions and acquiring banks are warned that any transaction touching the Smartpayz infrastructure is a direct breach of standard AML/CTF protocols. Due to its ghost status, there is no way to perform Enhanced Due Diligence (EDD) on this provider.

“If you see Smartpayz in your payment logs, you aren’t just looking at a risky partner—you’re looking at a hole in your compliance net,” the report concludes.

View the full “Ghost Profile” for Smartpayz.

About RatEx42: RatEx42 is the industry’s most aggressive compliance magazine and listing platform, focused on exposing the shadow rails of the global iGaming and crypto sectors.