The transition to MiCA (Markets in Crypto-Assets) has not eliminated risk; it has merely driven it underground. While Tier-1 institutions adopt “clean” rails, a parallel ecosystem—the Shadow Stack—has emerged to service the multi-billion dollar offshore iGaming and unregulated crypto sectors.

We are currently tracking a surge in “Intermediary Hopping,” where transactions are layered through multiple EU-based “technical service providers” to obfuscate the final destination of funds.

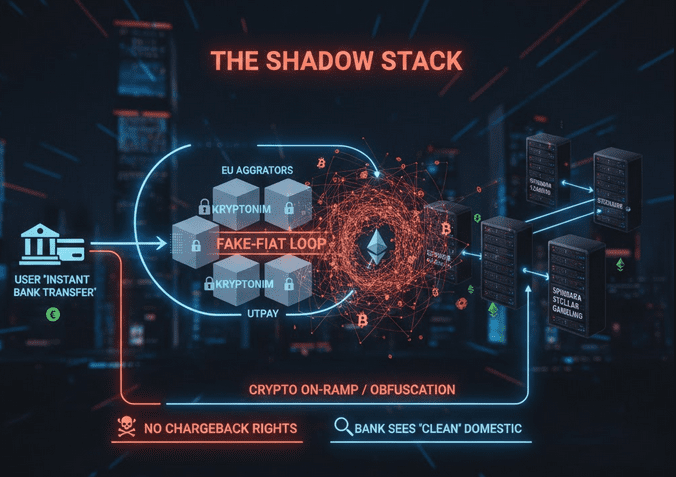

Forensic Analysis: Mapping the “Shadow Stack”

The most sophisticated threat we are documenting involves the “Fake-Fiat” Loop. This is a deceptive rail architecture designed to bypass bank anti-fraud filters.

The Anatomy of a High-Risk Transaction:

- The Facade: The user selects “Instant Bank Transfer” on an offshore casino (e.g., Spinbara or Stellar).

- The Aggregator: The flow is routed through a seemingly legitimate EU payment entity (often a Lithuanian or Polish VASP).

- The On-Ramp: The “bank transfer” is actually a trigger to purchase crypto (typically USDT or USDC) via a hidden on-ramp like Rillpay or the now-suspended utPay.

- The Settlement: The digital asset is instantly settled into the merchant’s offshore wallet, leaving the consumer with zero chargeback rights and the bank with a “clean” domestic transfer record.

📉 RatEx42 Risk Signals: Q1 2026 Watchlist

Our proprietary Traffic Light System has flagged the following entities due to confirmed regulatory arbitrage and licensing voids.

| Entity | Rating | Key Risk Indicators (KRIs) | Status |

| utPay (Utrg UAB) | ⚫ BLACK | MiCA Non-Compliance; Service suspension in Jan 2026; High-volume traffic from prohibited jurisdictions (81% Germany). | CRITICAL |

| Rillpay | 🔴 RED | Rail Opacity; Integrated into “fake-fiat” cashier structures; Opaque cross-border footprint (Canada/Colombia). | HIGH RISK |

| Daxchain | 🟠 ORANGE | Open Banking Hijacking; Allegedly using TPP credentials to facilitate offshore gambling deposits. | UNDER REVIEW |

| Chainvalley | ⚫ BLACK | Deposit Obfuscation; Repeatedly identified as a primary facilitator for “The Shadow Stack.” | CRITICAL |

Export to Sheets

Regulatory Reality Check: The MiCA Fallout

As of January 1, 2026, the “Wild West” era of Lithuanian VASPs has officially ended. Any entity operating in the EU without a full CASP (Crypto-Asset Service Provider) license is now technically an illegal operation.

- The “Technical Integration” Loophole: We are exposing firms that claim they only provide “technical software” while actually controlling the flow of funds. This is a major red flag for correspondent banks.

- Whistle42 Intelligence: Our latest leaks suggest that several “suspended” firms are attempting to migrate their merchant books to White-Label offshore mirrors in Anjouan or Costa Rica to continue servicing the iGaming sector.

Next Steps for Investigative Action

The evidence is clear: the obfuscation of transaction descriptors is the new frontier of financial crime. We must continue to map these rails until the “Shadow Stack” is fully transparent to regulators.