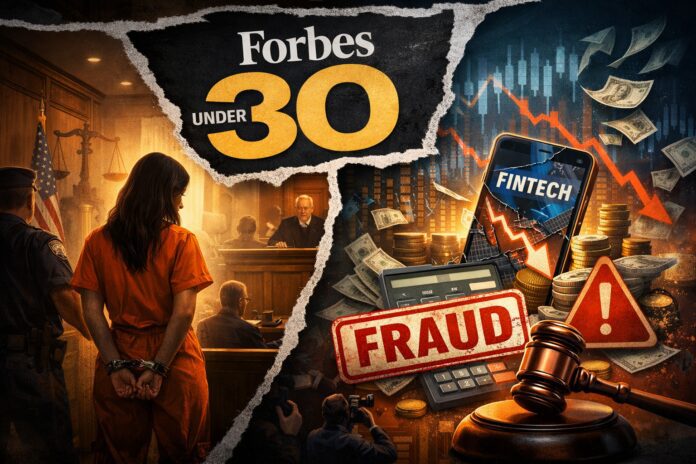

The Forbes 30 Under 30 list loves one narrative above all others: young, visionary, tech-driven — and disruptive.

Fintech founders fit that mold perfectly.

Which is why the latest scandal hits a nerve.

A celebrated fintech founder, once publicly endorsed by Forbes 30 Under 30, is now facing serious federal fraud charges. This case is not just about one individual — it exposes a recurring structural problem in the startup and fintech hype machine.

A Fintech Built on Inflated Numbers

According to prosecutors, the founder raised millions in seed funding for a fintech startup by misrepresenting revenues, partnerships, and business traction.

Investors were allegedly shown one version of reality — while internal figures told a very different story.

This was not a prototype-stage misunderstanding. It was allegedly a deliberate distortion of financial performance — the most sensitive metric in any fintech company.

In an industry built on trust, data integrity, and regulatory compliance, that is not a minor offense. It is existential.

Why Fintech Is Especially Vulnerable

Fintech startups operate at the intersection of:

- money

- regulation

- technology

- investor confidence

That combination creates enormous pressure to look credible — and big — at a very early stage.

Growth metrics, enterprise partnerships, transaction volumes: these are the currencies of fintech legitimacy.

But when storytelling replaces substance, fraud risk escalates quickly.

According to allegations, this case involved:

- inflated revenue figures

- overstated enterprise relationships

- misleading investor decks

- parallel financial narratives

These are classic red flags — wrapped in modern fintech branding.

The Forbes Effect

A Forbes 30 Under 30 badge is not neutral.

It functions as social proof, reducing skepticism and accelerating trust — particularly among early-stage investors, partners, and media outlets.

Once that stamp is applied, fewer people ask uncomfortable questions.

This is not the first time a fintech founder with high-profile accolades has ended up under criminal investigation. It is unlikely to be the last.

The Bigger Pattern

What we are witnessing is not an isolated scandal. It is a pattern:

- speed beats scrutiny

- visibility beats verification

- public relations beats proof

In fintech, that is a dangerous combination.

Regulators are catching up. Prosecutors are catching up.

And the gap between perceived success and verifiable reality is shrinking fast.

The RateX42 Take

This case reinforces a core RateX42 principle:

Awards are not audits. Media profiles are not due diligence.

Especially in fintech, numbers must be verified — not admired.

The next generation of founders will be judged less by magazine covers and more by:

- compliance maturity

- data integrity

- governance structures

- financial transparency

The era of “fake it till you make it” is ending — particularly in fintech.