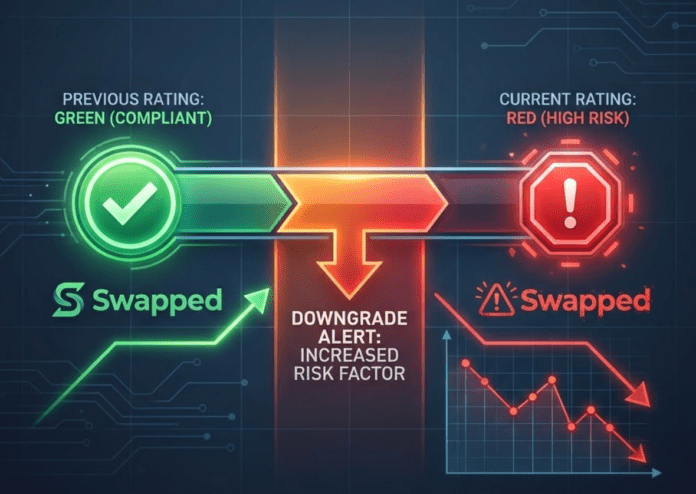

RatEx42, the leading compliance intelligence and risk-rating platform, has today officially downgraded Swapped (Swapped ApS) from a “Green” (Low Risk) rating to a Red (High Risk) listing. This drastic shift follows a multi-month forensic deep-dive into the platform’s merchant portfolio, revealing that Swapped has transitioned from a legitimate Nordic fintech into a high-capacity “shadow rail” for the unlicensed offshore iGaming industry.

The “Green” Illusion: Why We Were Deceived

For the past year, Swapped maintained a Green status on RatEx42. On the surface, the company presents a textbook example of regulatory compliance:

- Danish MiCAR Readiness: Registered with the Finanstilsynet (Danish FSA).

- Global Licensing Stack: Holding active registrations with FinCEN (US), AUSTRAC (Australia), and FINTRAC (Canada).

- Corporate Substance: Verifiable headquarters in Aarhus and a transparent leadership team led by CEO Thomas Franklin.

However, our latest investigation into “Layer 1 On-Ramps” has revealed that this extensive licensing stack is being utilized as a compliance shield. While the front-end remains regulated, the back-end has become a primary funding pipe for the gambling black market.

The Downgrade Rationale: Forensic Evidence

The decision to issue a Red Signal is based on the following critical findings:

- Systematic iGaming Facilitation: Swapped has been forensically linked to the cashier stacks of some of the most predatory unlicensed gambling groups, including Galaktika N.V. and Brivio Limited. It is currently a primary on-ramp for Ice Casino, Verde Casino, and SpinFin Casino.

- Transaction Masking: Our analysis of player bank statements shows that Swapped transactions are often coded with generic descriptors such as “Digital Assets” or “Software Purchase.” This intentionally bypasses the MCC 7995 (Gambling) filters used by Tier-1 banks, effectively tricking financial institutions into processing illegal gambling deposits.

- Regulatory Arbitrage: Swapped markets its “high-conversion” widget to operators who have been purged from stricter jurisdictions like Lithuania. By claiming its service is “non-custodial,” Swapped attempts to evade responsibility for the final destination of the funds—a legal loophole that MiCA 2026 is specifically designed to close.

The “Fake Bank Deposit” Mechanism

Swapped’s technical infrastructure allows a player to remain inside the casino’s interface while “buying” crypto through the Swapped widget. The crypto is then instantly routed to the casino’s offshore wallet. To the user’s bank, it looks like a legitimate purchase from a regulated Danish crypto firm. To the casino, it is a seamless, untraceable fiat deposit.

Compliance Verdict: High Risk (Red)

“The era of ‘compliance by registration only’ is over. A company can hold every license in the world, but if their primary business model is providing the plumbing for illegal offshore casinos, they are a high-risk entity. Swapped has chosen volume over integrity, and our rating now reflects that reality.” — RatEx42 Editorial Board

RatEx42 recommends that all financial institutions, acquiring banks, and payment service providers immediately re-evaluate their exposure to Swapped ApS and Swappedcom Inc.

Whistle42 Call to Action

Do you have internal data regarding the “onboarding” fees Swapped charges for high-risk gambling merchants? Your information is vital to mapping the 2026 shadow economy. Submit your evidence anonymously at Whistle42.com.