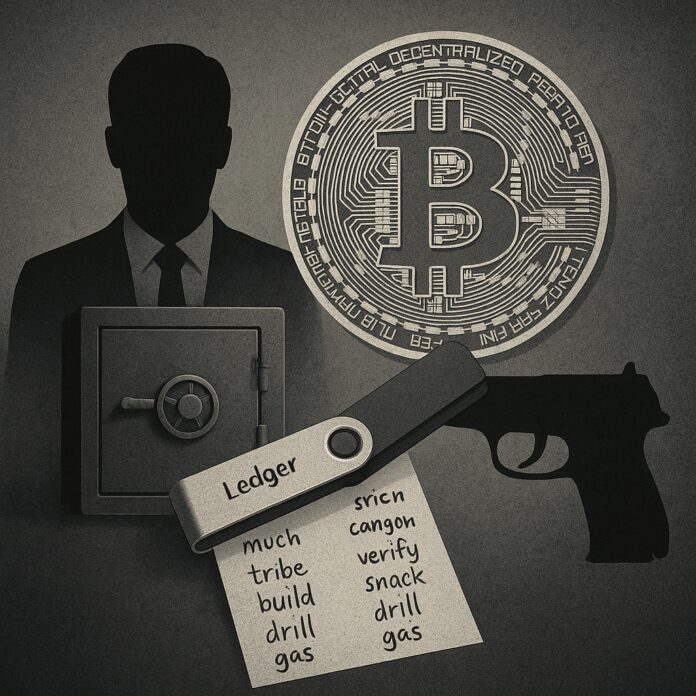

They operate from Swiss bunkers and Frankfurt safe rooms. Their clients are anonymous. Their protocols, extreme. And their greatest fear isn’t market volatility—it’s blackmail, kidnapping, and key loss.

The hidden threat behind crypto wealth

According to a recent investigation by Manager Magazin, a discreet layer of private firms across Europe now acts as the last line of defense for crypto billionaires. Their business: offline key custody.

But this isn’t about blockchain anymore.

It’s about physical vulnerability:

- Extortion

- Kidnapping

- Insider betrayal

- Long-term psychological pressure

These “crypto guardians” are not just storing keys—they are protecting clients from worst-case human scenarios.

A vault, not a protocol

One profile describes a Frankfurt-based “crypto trustee” who safeguards access to private Bitcoin wallets with protocols more suited to spy thrillers than financial management:

- Keys are split across multiple jurisdictions, stored in tamper-proof, air-gapped devices.

- Physical access requires multi-person presence, verified by video and biometric signatures.

- Emergency plans include lawyers, death protocols, and offline backups in sealed vaults.

The reason is simple: if you’re holding $500 million in BTC, you don’t fear volatility—you fear human leverage.

Extortion is no longer hypothetical

This isn’t just theoretical. Over the past decade, the crypto world has seen:

- Executives and miners kidnapped in Latin America and Eastern Europe

- Ransomware gangs demanding wallet access instead of bank wires

- Family members used as leverage in offline blackmail schemes

And as these assets become inheritable, portable, and invisible—threat modeling shifts from the internet to the street.

How crypto wealth is changing custody itself

Unlike traditional bank clients, early crypto whales often:

- Avoid public records

- Don’t trust centralized institutions

- Prefer non-custodial setups—until they feel real-world pressure

Enter the ultra-discreet private trustee market, where the actual service isn’t custody—it’s plausible deniability, physical risk management, and multi-jurisdictional fallback.

In other words: Don’t just protect the keys. Protect the person.

What this reveals about crypto’s core paradox

At its heart, crypto promised a world without middlemen. But the higher the value of the asset, the clearer one thing becomes:

Trustless money creates new trust bottlenecks.

When billions ride on twelve words, self-custody becomes a liability. But trusting others? That, too, becomes a risk.

So the industry turns to a grey area:

- Not exchanges

- Not banks

- Not regulated custodians

But private vault operators, fiduciaries, and lawyers with encryption skills.

A new kind of shadow banking—but for keys, not cash.

Final thought

In the world of crypto billionaires, the greatest fear isn’t losing money—it’s losing control.

The air-gapped laptop in the bunker is not just a symbol of security. It’s a monument to the psychological cost of self-sovereignty.

For some, Bitcoin is freedom.

For others, it’s a burden no one can help them carry.

Follow more deep-dive stories like this at RatEx42.com.