Black Banx

Key Data

- Trading Name: Black Banx (previously WB21)

- Legal Entity: Black Banx Holdings Ltd

Black Banx Inc. - Activities: globally-acting high-risk payment processor

- Location: Canada, Germany, United Kingdom

- Regulations: unregulated

- Key People: Michael Gastauer and Philip Gastauer

Black Banx (previously WB21) is a globally-acting high-risk payment processor. The German Michael Gastauer and his son Philip Gastauer are the owners. The company promises to get bank accounts for individuals and merchants in over 180 countries in just minutes.

Black Banx claims to have 8 million (now 20 million) customers and $10 billion in monthly transaction volume on LinkedIn and its website. We doubt the figures of this high-risk and dark side payment processor. The UK FCA has issued a warning against Black Banx.

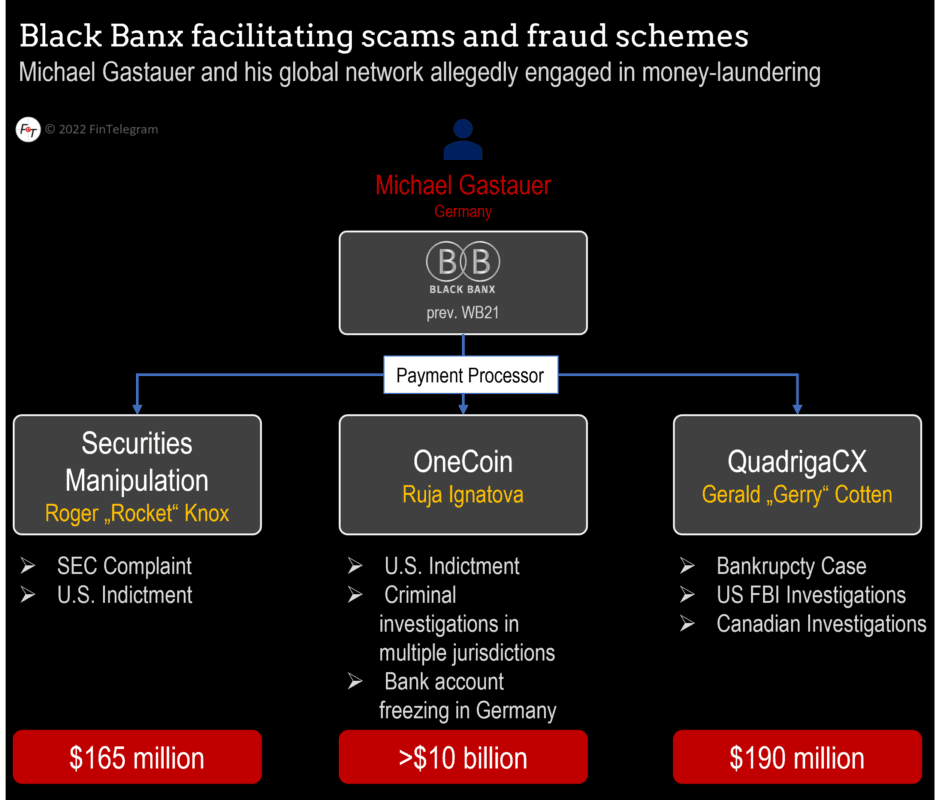

The truth, however, is that Black Banx and Michael Gastauer have been involved in huge scams such as OneCoin or QuadrigaCX.

Compliance Problems

In June 2022 the U.S. Securities and Exchange Commission (SEC) obtained a final judgment against Michael Gastauer, the German founder of the high-risk payment processor Black Banxscheme, for his role in an international scheme that generated more than $165 million of illegal sales of stock on the U.S. markets in at least 50 microcap companies. He is ordered to pay over $17 million. In 2018, the SEC charged Gastauer and six of his US-based entities with aiding and abetting a vast securities fraud scheme orchestrated by UK citizen Roger Knox.

News

Michael Gastauer, a self-proclaimed German FinTech billionaire, and his payment scheme, Black Banx, have faced allegations of involvement in illegal transactions and money laundering. However, the credibility and verifiability of these claims are questionable.

Controversial Background

Black Banx, formerly known as WB21, has been linked to processing funds for fraudulent cryptocurrency schemes and acting as a payment processor for a collapsed crypto exchange. These associations raise concerns about the legitimacy of the operation.

Legal Troubles and Doubtful Statements

Gastauer has faced legal troubles, including a $17 million fine for his involvement in a securities manipulation scheme. Furthermore, doubts arise regarding the accuracy of Black Banx’s claims, such as having 20 million clients and substantial website traffic, as website visitation statistics contradict these assertions.

Unrealistic Valuation

Reports suggesting a $50 billion valuation for Black Banx appear unrealistic when compared to established FinTech companies. The lack of substantial evidence and inconsistencies raise doubts about the claimed valuation.

Conclusion

Allegations surrounding Michael Gastauer and Black Banx bring into question their credibility and legitimacy. Further investigation is required to ascertain the truth behind these claims and evaluate the actual value and operations of Black Banx.

The latest Similarweb statistics (Dec 2022) say that between September to November 2022, only around 100,000 customers visited the website.

Black Banx would have more than twice as many customers as BaFin-regulated N26, which reported around 8 million customers. Similarweb says there were around 10 million people on the site between September and November 2022. That fits too!

Conclusion

We include Black Banx in our “Black Compliance” list, due to the articles and allegations on Fintelegram and the fines Michael Gastauer had to pay.

Please pay my pending invoice soon as possible

Hi

Hope you are doing well,

Your team member Elaine Sanderson

has worked with me, but your team member is not paying the invoice, 5 to 6 months have passed since the invoice was sent,so my company is suffering a lot, please reply on my this mail.and let me know how long it will take,

Here is my invoice , and your team member conversation screenshot,

Waiting for your positive response,

Thanks.