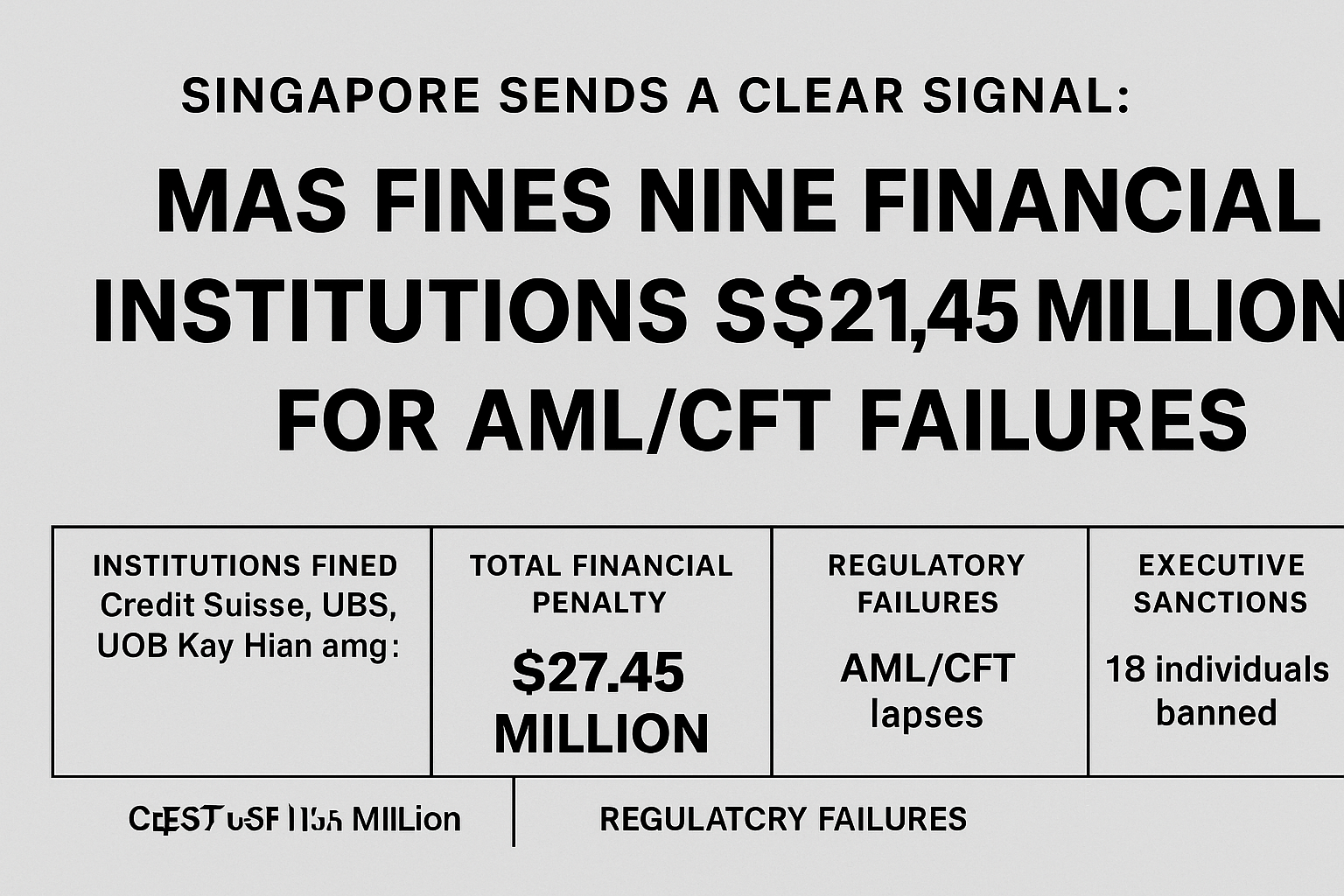

In one of the most comprehensive enforcement actions in its regulatory history, the Monetary Authority of Singapore (MAS) has imposed fines totaling SGD 27.45 million (approximately USD 21.5 million) on nine financial institutions. The penalties follow serious findings of non-compliance with anti-money laundering (AML) and counter-terrorism financing (CFT) requirements.

This action underscores MAS’s increasing scrutiny of both traditional and digital financial institutions, reinforcing that innovation does not exempt firms from regulatory obligations.

Institutions Sanctioned

The fined entities include a mix of private banks, capital market intermediaries, and trust service providers. Among those named:

- Credit Suisse

- UBS

- UOB Kay Hian Private Limited

- Trident Trust Company

- Blue Ocean Invest

Additional firms involved have not been publicly named. The enforcement action is detailed in the official MAS press release and covered by The Asian Banker.

Key Compliance Failures

MAS identified multiple systemic weaknesses, including:

- Inadequate customer due diligence during onboarding

- Failure to conduct proper risk assessments for high-risk clients

- Insufficient scrutiny of source-of-wealth documentation

- Weak or underdeveloped transaction monitoring systems

- Lapses in handling politically exposed persons (PEPs) and other persons of interest (POIs)

These shortcomings persisted over extended periods, indicating deep-rooted deficiencies in internal compliance frameworks.

Executive Accountability

In a significant escalation of enforcement strategy, MAS also issued prohibition orders against 18 senior executives, including CEOs, directors, and relationship managers. These individuals are banned from holding key roles in Singapore’s financial industry, with the bans commencing in August 2025 and extending, in some cases, until June 2031.

This action aligns with a growing global trend: holding individuals personally responsible for institutional compliance failures.

Broader Implications for Fintech and Financial Services

This case is particularly notable because it extends beyond legacy institutions to include fintech players and digitally native financial service providers. The enforcement action sends a clear message to the global financial community:

Growth and innovation must be matched with scalable, robust compliance systems. A tech-forward business model is not a shield against regulatory oversight.

The MAS decision reinforces Singapore’s reputation as a serious and forward-thinking regulator—supportive of innovation, but uncompromising on financial crime prevention.

Summary of Key Findings

| Area | Summary |

|---|---|

| Institutions Fined | Credit Suisse, UBS, UOB Kay Hian, Trident Trust, Blue Ocean Invest |

| Total Financial Penalty | SGD 27.45 million (approx. USD 21.5 million) |

| Regulatory Failures | AML/CFT lapses, inadequate risk profiling, poor source-of-wealth checks |

| Executive Sanctions | 18 individuals banned from financial roles (2025–2031) |

| Regulatory Message | Compliance is non-negotiable, regardless of firm size or model |