Excerpt

- A $245 billion stablecoin market is now parking over $127 billion in U.S. Treasury bills—enough to nudge money-market yields and regulators’ pulse.

- We dissect the new GENIUS and MiCA rulebooks, and the fire-sale risk if Tether or USDC holders all hit “redeem” at once.

5 Key Points

- Trump signed the GENIUS Act on 18 July 2025, mandating 1:1 fiat reserves and federal licensing for all USD-pegged stablecoins (Source: The White House).

- EU MiCA rules (in force since 30 Jun 2024) hand supervision to the EBA once a token tops €5 billion or 10 million users—and give the ECB veto power (Source: taylorwessing.com).

- Tether now holds $127 billion in Treasuries, booking $4.9 billion Q2 profit and climbing into the global top-20 list of U.S. debt holders (Source: tether.io)

- The top eight USD stablecoins surpassed $245 billion in market cap on 3 Aug 2025; Tether leads with $164.7 billion, USDC with $63.8 billion (Source: AInvest).

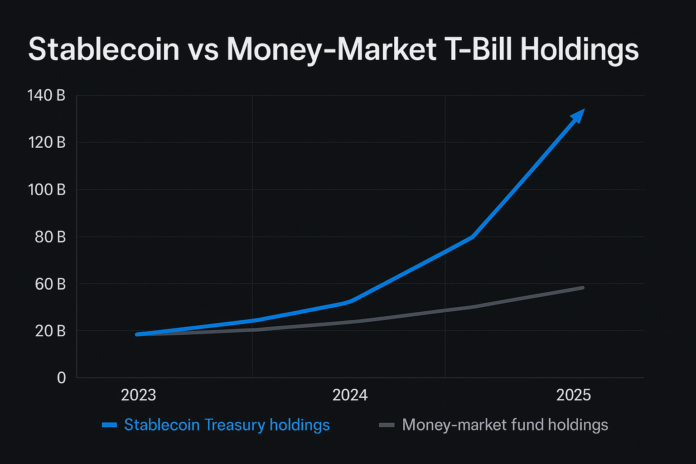

- BIS finds 2024 T-bill buying by Tether + Circle rivaled U.S. government MMFs; a $3.5 billion stablecoin inflow trims three-month yields by ~8 bps (Source: bis.org)

Short Narrative

Stablecoins—crypto tokens engineered to trade at par with fiat—have vaulted from fringe experiment to systemic hinge in two years. Washington’s GENIUS Act and Europe’s MiCA now treat large issuers like quasi-banks, yet their balance sheets look more like heavyweight money-market funds stuffed with short-dated Treasuries.

Tether alone added $20 billion of bills this year, while Circle and smaller rivals chase yield via repo. The problem: unlike banks, these entities lack a central-bank backstop. A sudden loss of confidence could force mass liquidation of safe assets into already-fragile bond markets—echoing the 2020 MMF dash-for-cash but on a blockchain-fuelled timeline (Sources: tether.io, bis.org).

Extended Analysis

Market Impact

Dollar-pegged coins now settle over $1 trillion in monthly on-chain volume, cementing their role as crypto’s de-facto cash leg. GENIUS tightens U.S. oversight, but by codifying Treasuries as “high-quality liquid assets” it also hard-wires the federal debt market into every stablecoin redemption cycle. Europe’s MiCA sets softer size thresholds yet adds ECB veto rights, signalling that cross-border spillovers—not just consumer harm—are the real worry (Sources: The White House,taylorwessing.com).

Liquidity Risk to Treasuries

BIS modelling shows that a mere $3.5 billion swing in stablecoin flows can move three-month T-bill yields by eight basis points—comparable to a surprise Fed repo operation. Fire-sale stress amplifies because issuers hold the same bills and repos; if redemptions spike, they dump in lockstep. Treasury desks still remember March 2020 when MMFs broke the buck; a blockchain run would unwind even faster thanks to 24/7 settlement (Source: bis.org,Reuters)

Regulatory Divergence

GENIUS focuses on reserve quality and audit cadence; MiCA zeroes in on caps, cross-currency exposure, and an orderly wind-down plan. Arbitrage emerges: issuers can domicile legal entities in whichever regime offers cheaper capital treatment, then passport tokens globally. That keeps supervisors in a perpetual race to the bottom—unless Basel or IOSCO harmonise disclosures at the international level.

Precedent & Run Scenarios

Algorithmic stablecoins like TerraUSD blew up in 2022, but even fiat-backed coins have wobbled when bank rails or custody partners froze. If Tether’s Cayman trust or Circle’s bank network hiccups, redemption requests funnel into the same short-term paper, draining dealer balance sheets and ricocheting into repo. BIS warns such feedback loops could blunt monetary-policy transmission just when central banks need agility (Source: Reuters).

Investment Implications – Risk-Reward Matrix

- Bull Case:

- Stablecoins cement dollar hegemony in DeFi; demand for short bills stays bid.

- GENIUS compliance could open Fed master-account access, lowering counter-party risk.

- Bear Case:

- Redemption shock forces $100 billion T-bill dump, spiking funding costs and crypto spreads.

- MiCA caps throttle EU-based issuance, shifting liquidity to less-regulated venues.

- Wildcard:

- U.S. debt ceiling scare collides with a stablecoin run, turning a routine political drama into a global liquidity crunch.

Recommendation or Warning

Treat stablecoin exposure like an unregulated money-market fund—size your tail-risk limits accordingly, or stay sidelined.