Introduction and Business Activity

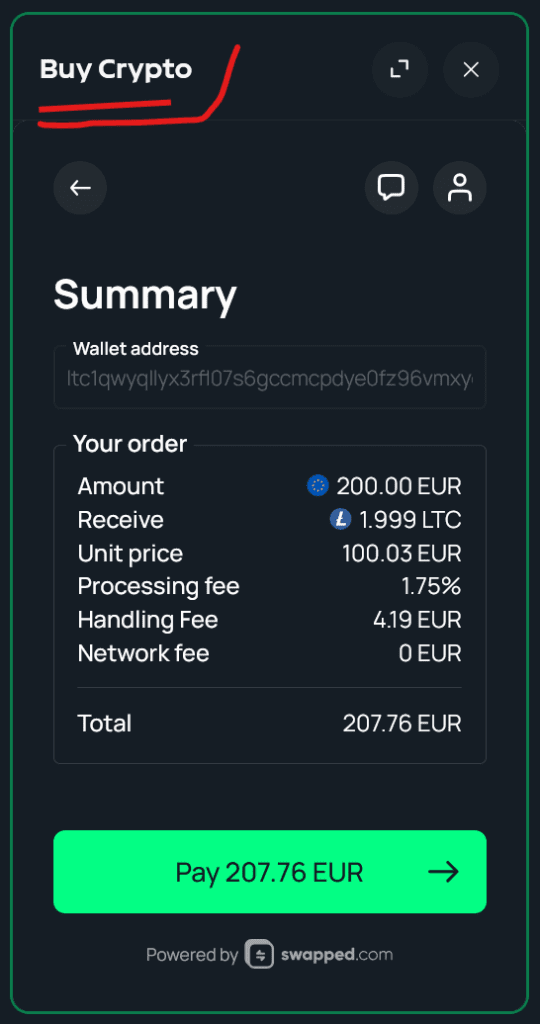

Swapped is an international crypto payment processor positioning itself as a regulatory-compliant bridge between FIAT and cryptocurrencies. The platform enables users and businesses to purchase, exchange, and pay with crypto assets using a wide range of payment methods—credit/debit cards, bank transfers, and alternative payment solutions. Swapped’s growing B2B segment includes seamless “in-platform” crypto purchasing integrations for online merchants, most notably gambling operators.

One high-profile use case is Swapped’s direct integration with GamDom, a widely used crypto casino that accepts European FIAT payments for gambling in Bitcoin and other cryptocurrencies, even in jurisdictions where such activity is illegal or unlicensed.

Corporate Structure and Key Stakeholders

- Primary Legal Entity:

Swapped ApS

Rosbjergvej 22A, 8220 Brabrand, Denmark

Company Registry: 42865397 (Danish CVR) - Other Corporate Entities:

- Swappedcom Inc. (USA, Delaware: EIN 38-4342884)

- Australian Branch: Registered with ASIC, ACN 670 910 291

- Leadership and Control:

Swapped does not widely publicize information about its beneficial owners or controlling individuals. Standard sources and public records confirm Danish and international business and compliance officers, but transparency remains limited regarding executive decision-makers and ultimate beneficial ownership. This lack of transparency is a red flag in financial compliance, especially in the high-risk crypto payments sector. - Web presence: www.swapped.com

Regulatory Status

Swapped presents itself as a legitimately regulated payment business:

- Danish Financial Supervisory Authority (Finanstilsynet): Registered as a crypto-asset service provider (CASP) and passportable across the EU under MiCAR.

- FINTRAC Canada: Registered Money Services Business (MSB), obligated for AML/CTF compliance in Canada.

- Australian Securities & Investments Commission (ASIC): Registered for operations through a branch entity.

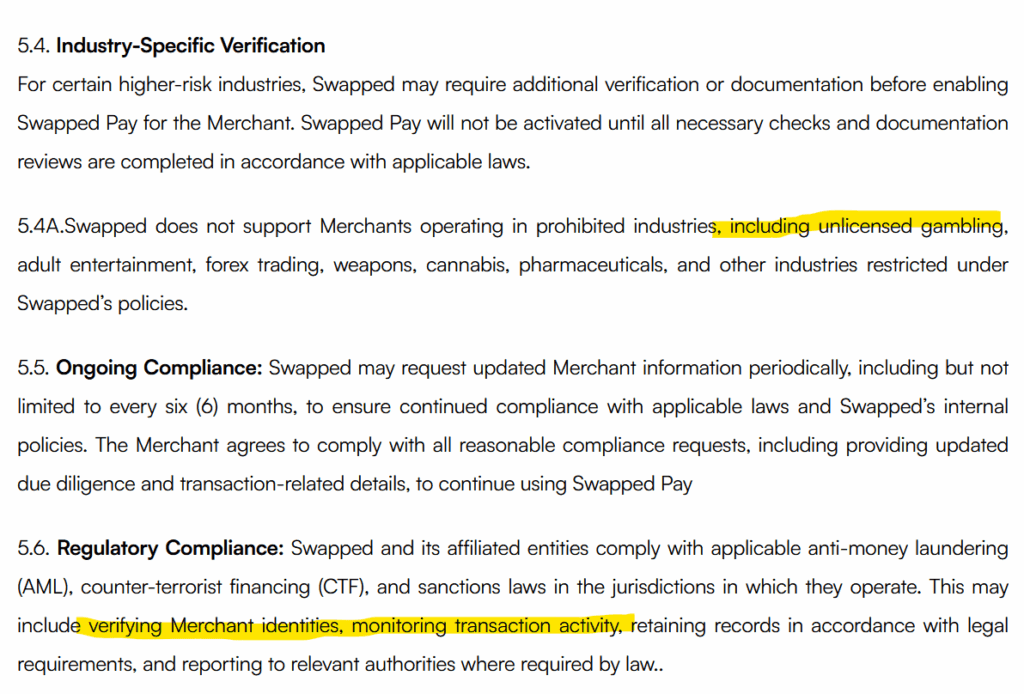

Swapped boasts a compliance framework with KYC and AML checks and claims strict industry vetting, including the explicit prohibition of using its services for illegal or unauthorized gambling, as stated in its Terms of Service.

Compliance Concerns and Practical Reality

Despite its self-claimed regulatory posture, FinTelegram’s investigations reveal that Swapped is actively facilitating transactions for GamDom and potentially other crypto casinos operating without required licenses in the EU and UK.

This means consumers in Spain (whose regulator has already imposed sanctions), Austria, Germany, Italy, and the United Kingdom are able to use Swapped to gamble on offshore platforms that are specifically prohibited for targeting their residents.

This is not a minor loophole:

- The Spanish DGOJ has fined GamDom’s operator, Smein Hosting, €5 million for unlicensed activity.

- German law (GlüStV 2021) and Italian/UK regulations explicitly prohibit offshore gambling—especially where operators and intermediaries are aware of their target market’s restrictions.

- Swapped’s integration with these services is not merely a passive payment solution—it provides the core technical bridge for converting FIAT to cryptocurrencies for gambling, knowing (or negligently disregarding) that such acts contravene major European licensing requirements.

Swapped’s “prohibited activities” clauses in its ToS for Merchants are functionally ignored in practice, raising serious questions regarding the company’s compliance culture, merchant onboarding/monitoring, and the strength or sincerity of its regulatory attestations.

FinTelegram Statement and Next Steps

FinTelegram has formally reached out to Swapped’s management for comment and clarification regarding these regulatory violations and their ongoing commercial relationships with unlicensed gambling platforms. Swapped management has been notified that a failure to respond will be publicly noted, with all provided statements published in full context.

Compliance Assessment Summary

- Regulatory facade—Swapped leverages registrations in Denmark, Canada, and Australia, but fails on ongoing monitoring and enforcement of its own ToS and AML/market conduct expectations.

- Facilitation of illegal gambling—By knowingly serving operators like GamDom in restricted jurisdictions, Swapped is not just failing in compliance, but is potentially complicit as a facilitator of illegal online gambling.

- Lack of transparency—Reluctance to disclose full beneficial and operational control further undermines trust and exposes the platform to substantial regulatory and reputational risk.

FinTelegram will publish all updates and management responses as they become available, and calls on all stakeholders and whistleblowers to provide further evidence regarding Swapped, GamDom, and similar high-risk payment/gambling partnerships via Whistle42.

Share Information via Whistle42

This report is produced as part of our ongoing financial crime and regulatory monitoring work on the crypto gambling and payment processor sector. FinTelegram stands for transparency, integrity, and consumer protection in global finance.